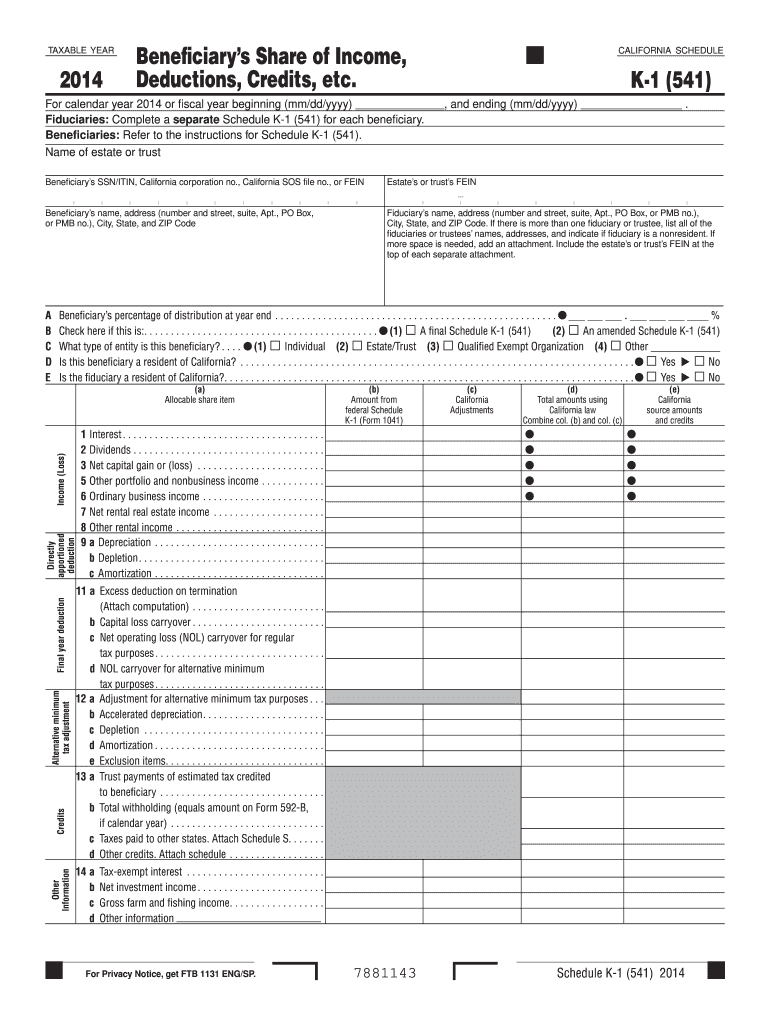

2024 Form 1041 Schedule Date – Inheriting property or other assets typically involves filing the appropriate tax forms with the IRS. Schedule K-1 (Form 1041) is used to report a beneficiary’s share of an estate or trust . Non-charitable beneficiaries pay taxes on the income they received. The income must be reported on Schedule K-1 (Form 1041), Beneficiary’s Share of Income, Deductions and Credits. The money .

2024 Form 1041 Schedule Date

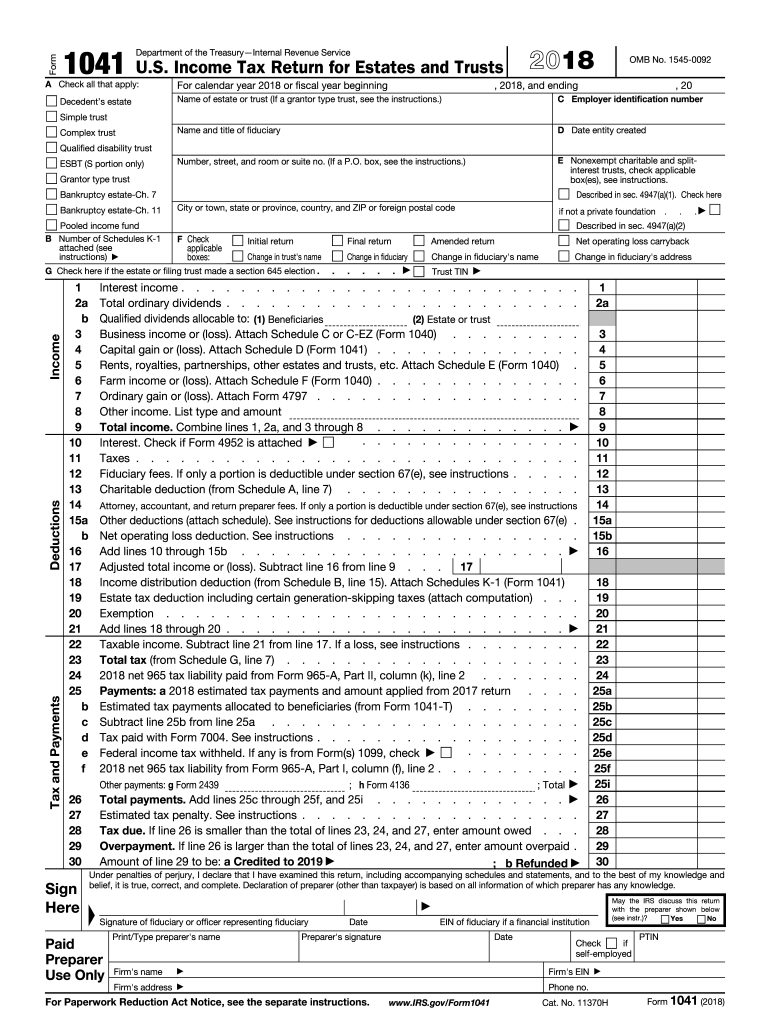

Source : www.getcanopy.com1041 form: Fill out & sign online | DocHub

Source : www.dochub.comTax Filing Deadline Dates 2024

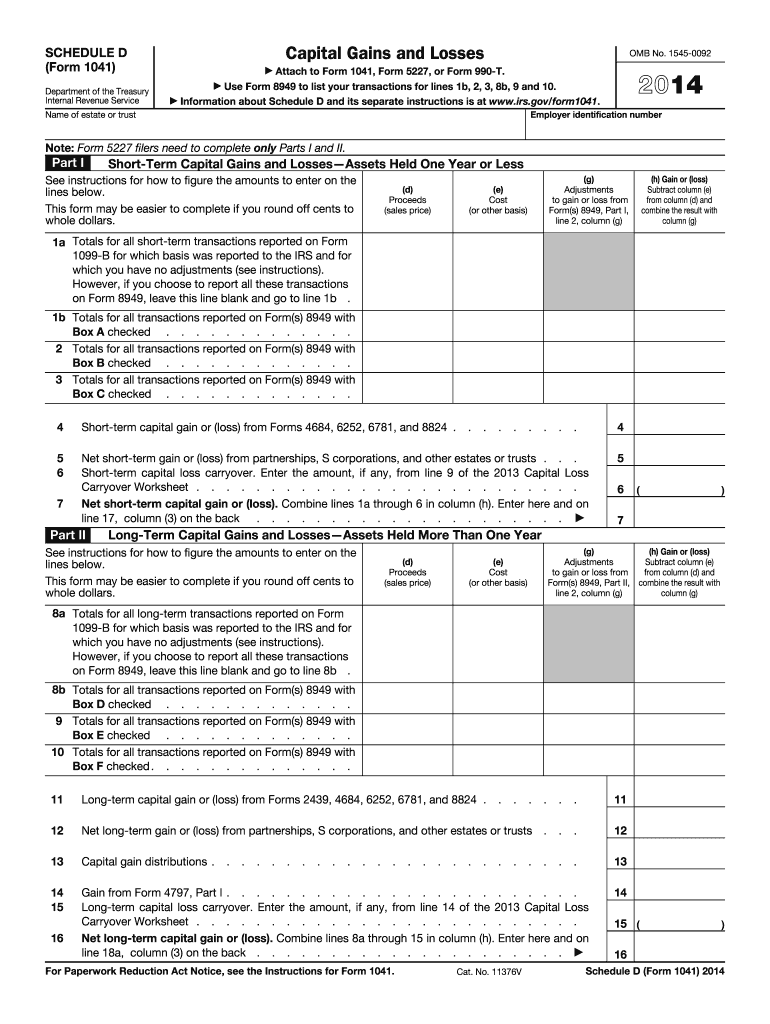

Source : www.fusiontaxes.comIrs form 1041 schedule d: Fill out & sign online | DocHub

Source : www.dochub.comWhat Is IRS Form 1041?

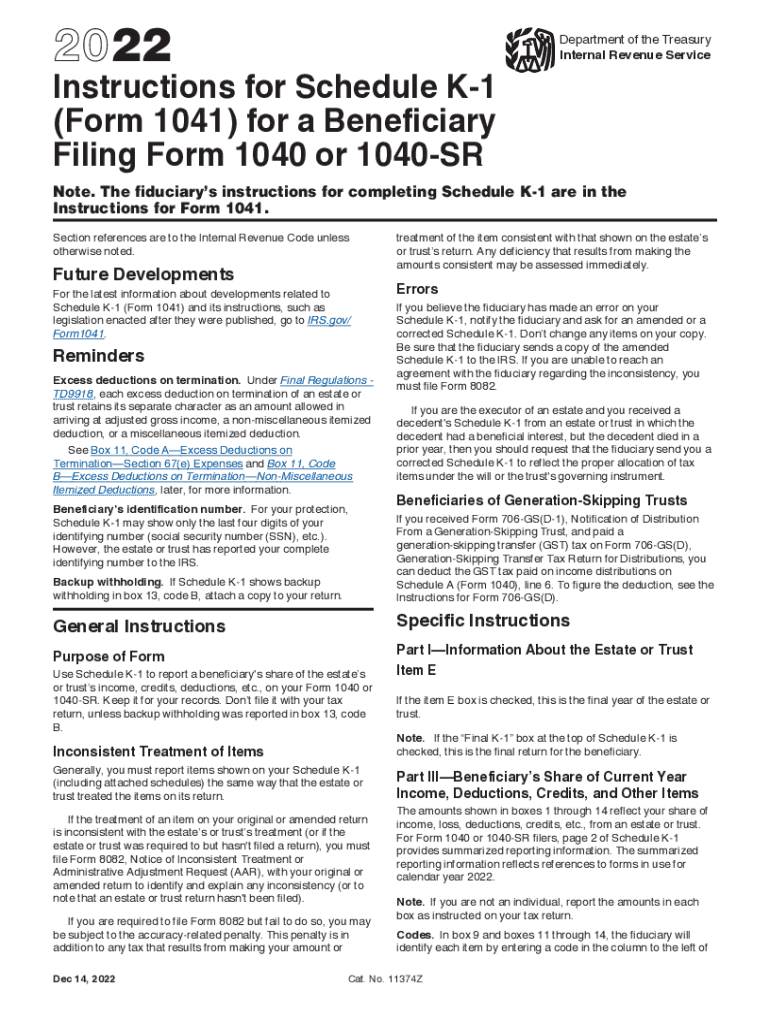

Source : www.thebalancemoney.comK1 instructions filling: Fill out & sign online | DocHub

Source : www.dochub.comLegacy Financial Services: Tax Resources

Source : www.legacyfsc.comK1 tax form: Fill out & sign online | DocHub

Source : www.dochub.comForm 1041 and Form 706

Source : accountslearn.comSchedule 1 2022: Fill out & sign online | DocHub

Source : www.dochub.com2024 Form 1041 Schedule Date A 2024 Overview of IRS Form 1041 Schedules: If you are having trouble filling out this form, please use the Firefox browser. Please note that items with an asterisk (*) are only available at limited locations . Please review the registration calendar to determine when the form is accepted. This form is provided for: Please select one of the following to proceed to the registration form. Active Login: I am a .

]]>

:max_bytes(150000):strip_icc()/Form1041-36b8feef0014418ab6aa150c951c7609.png)